Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

There is news in the market that Dan bin, a private placement boss, is suspected to be short, and the net value of hundreds of products fluctuates almost zero. The first financial reporter contacted Dan bin by telephone, and Dan bin responded that “the position should be relatively low, about 10%.”, On the morning of March 25, Dan bin, chairman of Shenzhen Oriental Harbor Investment Management Co., Ltd., responded to the “suspected short position” report through his personal response, saying that the report was written objectively. In fact, every major decision is not easy. We have to pay considerable “mind” and bear the corresponding consequences and outcomes. “From February 2021 to February 2022, our A-share and Hong Kong stock investment has been very bad for a whole year”. (source: times. Com),

market has news that private placement boss Dan bin is suspected to be short, and the net value of hundreds of products is almost zero fluctuation. The first financial reporter contacted Dan bin by telephone. Dan bin responded that “the position should be relatively low, about 10%

related reports

on the morning of March 25, Dan bin, chairman of Shenzhen Oriental Harbor Investment Management Co., Ltd., responded to the “suspected short position” report through his personal response, saying that the report was written more objectively. In fact, every major decision is not easy. We have to pay considerable “mind” and bear the corresponding consequences and outcomes. “From February 2021 to February 2022, our A-share and Hong Kong stock investment has been very bad for a whole year”. (source: Times)

since this year, the stock market has fluctuated sharply, and private placement has suffered serious floating losses. Under the dual pressure of investment side and client side, some private placement have chosen to reduce their positions.

and

Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

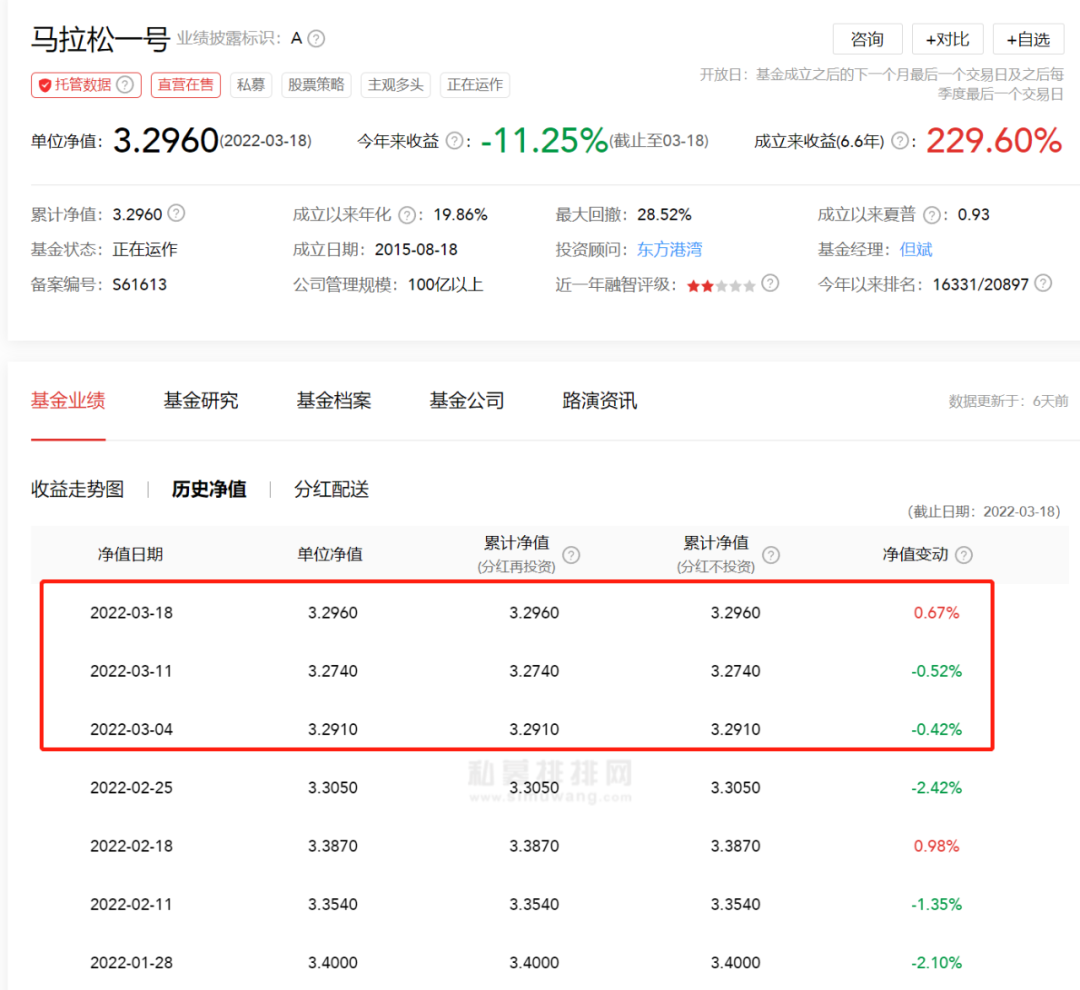

Chinese reporters found that hundreds of products of private placement boss Dan bin were suspected to be in short or light positions. Private placement data show that since March, danbin’s products have updated their net value three times, but the net value fluctuation of almost all products is close to 0. Other private placement products with updated net worth have retreated sharply due to the sharp decline in the market in March.

and

speculate that Dan bin may have significantly reduced his position as early as the end of February, and the last time Dan bin was suspected to be short in the second half of 2018. However, just six months later, the market started a bull market for more than two years under extreme pessimism. Dan bin also significantly increased his product position, and his net value continued to rise. According to the data of

and

, as of March 11, the private placement position index of 10 billion shares was 78.46%, down 2.28% month on month, a new low for the year.

and

according to the Chinese reporter of the securities firm, a number of star private placement recently held customer communication meetings to appease investors. Gao Yuncheng, general manager of Jinglin assets, said that the most difficult panic stage had occurred last week. For those companies that have experienced a cycle and maintain or enhance their core competitiveness, they should buy heavily and hold for a long time. Since March, Dan Bin has seen hundreds of products fluctuating to 0

and

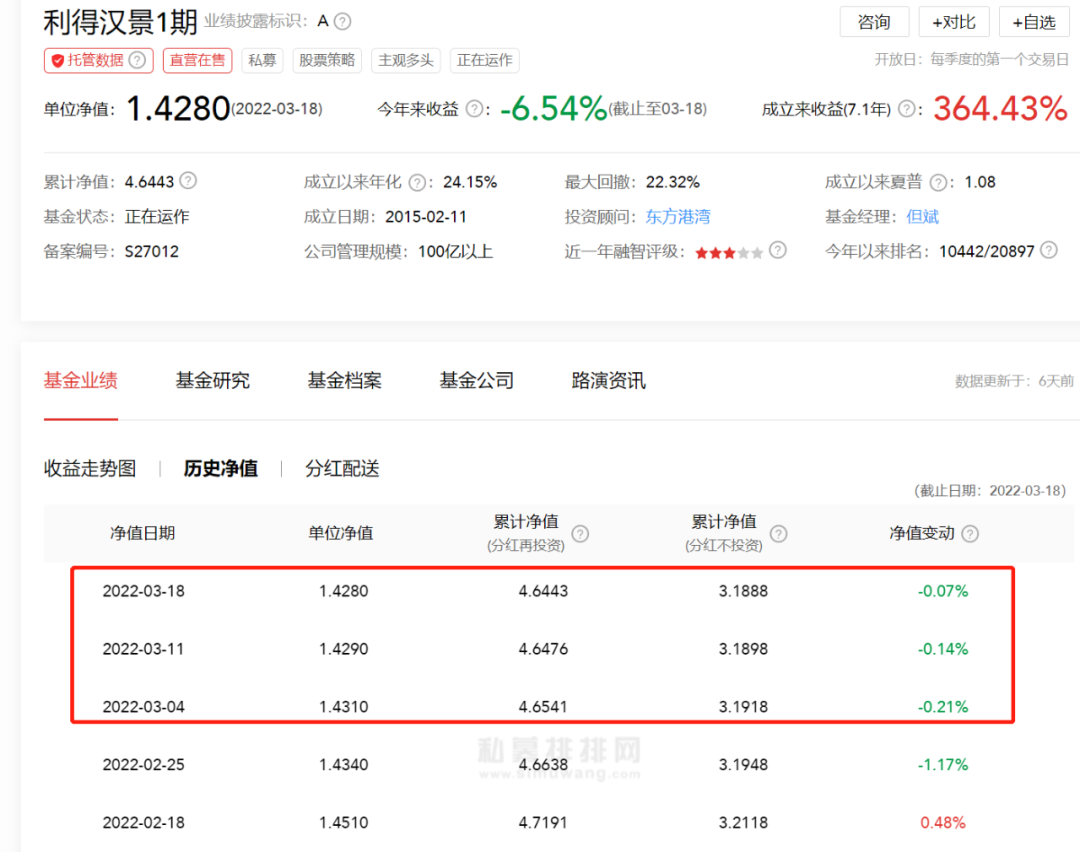

as one of the old private ones in China. The Eastern Harbour has gone through almost all the stock market crises, including the 2008 economic crisis and the Baijiu crisis in 2013 and 2014, and the volatility of the stock market in 2015 in March.

and

were pulled back beyond expectations in 2022, and Dan bin was tested again. This time, Dan bin seems to have adopted the same coping strategy as in 2018. The Chinese reporter of

and

securities companies found that hundreds of products of Dan bin were suspected to be in short or light positions. Private placement data show that since March, danbin’s products have updated their net value three times, but the net value fluctuation of almost all products is close to 0.

and

Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

for example, the representative products marathon No. 1 and marathon No. 2, which have been established for six years, have net value changes of -0.42% ~ 0.67% and -0.47% ~ 0.61% in the past three net value cycles. The net value changes of Lide Hanjing, which has been established for seven years, are only -0.07% ~ 0.21%. The net value changes of Marathon No. 8 are -0.12% ~ 0.21%, and the blue sky of Oriental harbor are -0.14% ~ 0.07%. Most other products are like this, and the net value is almost unchanged for three consecutive weeks.

,  ,

,  ,

,

however, the past three weeks have been the most volatile cycle for a shares and Hong Kong shares. Other private placement products that update their net worth have significantly retreated, and the net worth of many products retreated by 5% or even 10% a week.

and

are calculated according to the net value of Dongfang harbor. As early as the end of February, Dan bin had been short or light warehouse operation, and some products had only single digit very low positions. Finally, he was lucky to avoid the sharp fluctuation of the market in March.

and

, and the last time Dan bin suspected short position was in the second half of 2018. Take Lide Hanjing, which has been established for seven years, as an example. In many months at the end of 2018, the change of its net value was almost 0.19. At the beginning of 2019, the market started a bull market for more than two years under extreme pessimism. Dan bin also significantly increased his product position, and his net value continued to rise.

and

Dan bin once suffered a cut in half in 2008. Since then, Dan bin has been more cautious about product risk control, because he can carry the temporary floating loss, but the customer is often difficult to bear. Redemption at a low price will lead to the loss of both the customer and the company.

,  ,

,  ,

,

Dan bin disclosed the capital scale of the company for the first time, saying that he had experienced another test.

and

on March 23, on the 18th anniversary of the founding of Dongfang harbor, Dan bin disclosed the capital scale of the company for the first time, saying that the current management scale of Dongfang harbor is close to 30 billion. Baijiu

has also made a difference in the company’s success and volatility. Dan Bin also said that despite the economic crisis of 2008, the liquor crisis of 2013 and 2014 and the sharp fluctuations in the stock market in 2015, the long-term partners and friends of the Eastern Harbour have wonderfull life in general. Of course, at this moment, after six years of prosperity since 2015, Dongfang harbor A-share and Hong Kong stock investment have once again withstood the test after February 2021.

and

Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

are also verified on the side. Dan bin reduced his position to a very low level and led investors through the most panic moment.

,  and

and

it is worth noting that at the end of February this year, Dan bin announced that all products with a cumulative net value of less than 1 yuan will no longer charge management fees until the net value rises to more than 1 yuan. Dan Bin said that this decision may reduce the company’s revenue by nearly 100 million, which will benefit the company’s economyThe camp brought pressure.

Dan bin once said: “in the rose of time, I said that if I can’t invest well, it must be because of my professional ability, not because of my character. I promise!” Some industry insiders of

and

said that as the head of 10 billion private placement, Dan Bin’s move is quite responsible. The exemption of management fee shows the responsible attitude of private placement managers to avoid panic redemption and damage the interests of holders.

and

however, in the past two years, Dongfang harbor investment has also experienced a difficult challenge. In the first half of 2020,

and

were in COVID-19’s most difficult time. Dan Bin turned against the situation and opened up all the bullets. After the successful bottom reading, the performance of Dongfang Harbor was very bright this year. In the second half of the year, funds from major channels poured in. The management scale of Dongfang harbor successfully exceeded the 10 billion mark, soaring all the way to 20 billion or even up to 40 billion, but there is often a crisis behind the highlight.

and

however, at the beginning of 2021, the stock market peaked rapidly, and the net value of a number of products raised at a high level quickly retreated. In May last year, a product under danbin touched the early warning line.

and

in 2022, due to the unexpected decline of the market, the private placement industry is entering the winter. Dan bin is no exception. In early February this year, the net value of 50 products under Dongfang harbor fell below 0.8 yuan, and the net value of 6 products fell below 0.7, of which a small number of products touched the early warning line.

on the evening of February 11, Dan Bin said on his microblog, “at present, our products have made corresponding risk control, and the net value is relatively stable. The trading department and I have always been cautious.” A number of

and

star private placement held customer communication meetings to firmly look at the market. According to the data of

and

private placement network, as of March 11, the 10 billion stock private placement position index was 78.46%, down 2.28% month on month, a new low for the year. Among them, 59.74% of the 10 billion stock private placement positions exceed 80%, and 12.70% of the 10 billion stock private placement positions are less than 50%. Obviously, the market still needs more confidence.

and

recently, a number of star private placement have recently held customer communication meetings or sent letters to investors.

Zhongbo Wu Weizhi said at the strategy meeting a few days ago, “I don’t know how much it will eventually fall, but no winter will not pass, and there will be the next bull market. Investors’ sentiment will become more pessimistic when they lose money and more crazy when they make money.” Gao Yuncheng, general manager of

and

Jinglin assets, said at the online customer communication meeting on Wednesday that the high probability in the first quarter of this year is the most difficult time for the stock market. From the perspective of liquidity and expectation, the most difficult panic selling stage should have occurred last week. Extreme expectations are reversed on the margin, and the market is about to find the bottom of performance. For those companies that have experienced a cycle and maintain or enhance their core competitiveness, they should buy heavily and hold for a long time.

and

old 10 billion private placement Danshui spring also pointed out in the recent roadshow that the market does not have the conditions for a sustained bear market throughout the year. The adjustment at the beginning of the year has laid the main tone for the expected repair this year, and the repair is expected to be realized gradually. From the perspective of time dimension of 1-2 years, once the spread and continuous performance of different opportunities appear in the market, the investor sentiment changes from pessimism to optimism, which does not rule out the possibility of systematic opportunities at the index level.

and

Education, Smartphone, Advertisement, Intelligent Office, Laptop, Smartphone, Wireless Conference, Wireless Synchronizing Screens

Shiva assets Liang Hong issued “a letter to investors” to apologize to all investors for the poor performance in the past year, causing temporary losses to everyone and their mistakes in all aspects. “As far as we know, the domestic mainstream quantitative private placement managers have not taken the initiative to reduce their positions during the market fluctuation this year, which is mainly due to their firm optimism about the long-term development of China’s capital market and their confidence in their own strategies,” said Mingyu investment, a 10 billion quantitative giant of

and

and

it is reported that all products of Mingyu were in net buying status during this period. Among them, hedging series products increased positions in different proportions according to their own risk exposure coefficient, which was basically at the historical peak in mid March; Quantitative long series products are full warehouse strategy in itself. “Different from overseas hedging products, domestic mainstream quantitative products are quantitative bulls. One of the strategic characteristics is full warehouse. This mainstream product line is the backbone of long market.”

(source: First Finance)